Wednesday, 14 January, 2026г.

Где искать: по сайтам Запорожской области, статьи, видео ролики

пример: покупка автомобиля в Запорожье

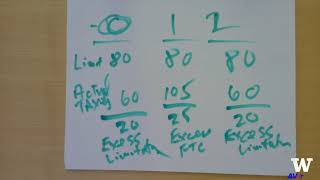

Alex Ferrara Coporate Tax Rates

Tax Cuts & Jobs Act.-Changes to the C-Corporation tax rates for 2018.

C-Corp profits are taxed to the corporation when earned and then taxed to the shareholders when distributed as dividends. This is double taxation.

Check the video and charts out to see the how your accounting, law, engineering or consulting firm (just to name a few) might be impacted.

If you have any questions or need any additional tax planning, we here at Hall, Kistler would be happy to help. Please give us a call at 330-453-7633.

Теги:

Tax Cuts & Jobs Act Accountants 44702 Alex Ferrara Hall Kistler & Compamy Hall Kistler C-Corporations C-Corps C-Corp tax rate 2018

Похожие видео

Мой аккаунт

У вашего броузера проблема в совместимости с HTML5

У вашего броузера проблема в совместимости с HTML5