Monday, 12 January, 2026г.

Где искать: по сайтам Запорожской области, статьи, видео ролики

пример: покупка автомобиля в Запорожье

What is a Controlled Foreign Corporation, and why should you care?

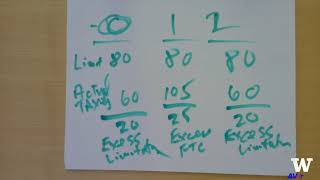

Contact us at 888-727-8796 if you need assistance with your foreign or domestic tax problem (and yes, your information will be subject to the attorney client privilege). We’ve successfully assisted thousands of clients deal with IRS issues. You can also email us at [email protected]. www.irsmedic.com In Part 1 of our Controlled Foreign Corporations/Form 5471 video series, we talk about what a Controlled Foreign Corporation (CFC) is, and why they are such a big deal to the IRS and US persons investing overseas. What is a Controlled Foreign Corporation? A CFC is a corporate entity that is registered and conducts business in a different jurisdiction or country than the residency of the controlling owners. In the US, control of the foreign company is defined according to the percentage of shares owned by U.S. citizens. Great, but why is this so important? It's all part of changes made in 1962 to prevent tax avoidance from setting up offshore companies in places with little or no tax. How can someone avoid taxes with offshore corporations? Prior to 1962, it was easy....but now it is difficult. And it worked as simply as this: A US person could fund an offshore corporation and be its sole shareholder, and that corporation could invest and earn passive income. All that passive income was non-taxable unless it was repatriated back to the US. This is what is known as deferral. Deferral is a legal way to avoid taxes until a later point. Because of the present value of money and the fact that having money grow tax-free is always better than it not growing tax-free, deferral was frowned upon by a federal government that wants more money. Deferral is fairly well-known to most people, albeit under a different structure. A common form of deferral is a 401(k) plan. Subpart F: Ugh. Again, indefinite deferral means the US Treasury gets no money. And that makes the government so sad. So very sad. In 1962 Subpart F was passed, in part to alleviate its sadness, and more likely to increase revenues. Now what happens in the corporation doesn’t necessarily stay in it, but rather gets attributed to you as income in that year. Subpart F is even more terrible than that --- the income is taxed at ordinary rates, even though the investment would have otherwise been taxed at lower passive rates. The way to combat Subpart F is with the use of Form 8858, and make sure you "check the box" to disregard the entity. Then all income is passed through to the taxpayer and is taxed at whatever rate the investment would be taxed at; that is dividend, passive real estate rates of 15/20%. Link to Subpart F video/article that Anthony referenced: https://www.irsmedic.com/2015/01/14/international-tax-planning-strategies/ http://www.irsmedic.com Serving US taxpayers worldwide "Real Tax Attorneys for Tough Tax Problems" IRS Medic: Parent & Parent LLP 212.256.1335 888-727-8796 Twitter: https://twitter.com/irsmedic Facebook: https://www.facebook.com/TheIRSMedic

Теги:

Controlled Foreign Corporation CFC Subpart F IRSMedic Form 5471 Form 8858 offshore companies tax shelter offshore tax shelter controlled foreign company cfc rules cfc tax subpart f income controlled foreign companies foreign corporation controlled foreign corporation rules controlled foreign company rules controlled foreign corporations international tax attorney cfc rule cfc irs cfc taxation foreign company what is controlled foreign corporation

Похожие видео

Мой аккаунт

У вашего броузера проблема в совместимости с HTML5

У вашего броузера проблема в совместимости с HTML5