Tuesday, 13 January, 2026г.

Где искать: по сайтам Запорожской области, статьи, видео ролики

пример: покупка автомобиля в Запорожье

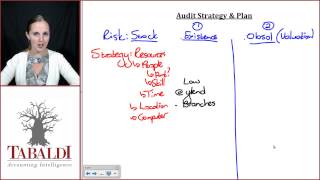

Special Audits | Excise Duty by Central Excise Department | Audit Under Value Added Tax | Part 5

Advanced Auditing and Professional Ethics: Chartered Accountancy;

Special Audits | Excise Duty by Central Excise Department | Audit Under Value Added Tax | Part 5;

Topics Covered :

Special Audits (Remaining Content)

1. Excise Audit by Central Excise Department : 00:00:49 - 00:09:35

- To understand cheque in advance

- Makes one Understand the Business Records of Assessee

- Procedures in Excise Audit

a. Selection of Assessee

b. Desk Review

c. Preliminary Investigation

d. Factory Visits

e. Audit Plan

f. Verification

g. Audit Objections

h. Audit Report

2. Audit Under Value Added Tax (VAT) [CA Final Nov'07'10] :

00:09:35- 00:13:40

- What is VAT?

- Preliminary Steps in VAT Audit

(a) Knowledge of Business

(b) Knowledge of VAT Law & Allied Laws

(c) Accounting Records

(d) Evaluation of Internal Control

3. Approach to Audit under Value Added Tax (VAT) : 00:13:42 - 00:19:40

- Audit programme for VAT Audit

- Audit Report Under VAT Law [CA Final May'10]

Video by Edupedia World (www.edupediaworld.com), Free Online Education;

Download our App : https://goo.gl/1b6LBg

Click here,

https://www.youtube.com/playlist?list=PLJumA3phskPG8HPVY4PNbHHjBMxGLkWFl

for more videos on Advanced Auditing and Professional Ethics;

All Rights Reserved.

Теги:

Special Audits Special Audit part 5 Special Audits remaining content Special Audit Excise Audit Excise Audit By Central Excise Department Procedures in Excise Audit Special Audt Audit under Value Added Tax Steps in auditing VAT Steps in VAT Audit Audit programme for VAT audit Audit report under VAT LAW Special Audit steps in auditing VAT Special Audit aproaches to audit under VAT Special Audit audit programme for VAT audit Special Audit VAT Audit Excise Audit

Похожие видео

Мой аккаунт

У вашего броузера проблема в совместимости с HTML5

У вашего броузера проблема в совместимости с HTML5