Saturday, 17 January, 2026г.

Где искать: по сайтам Запорожской области, статьи, видео ролики

пример: покупка автомобиля в Запорожье

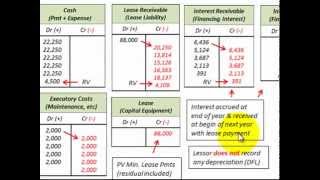

Interest Rate Swap Hedge Against Notes Payable (Debt) Gain Or Loss On Swap Contract

Interest rate swap contract hedge against fixed debt (Notes Payable), Company issues Notes Payable and at same time buys an interest rate swap contract betting that interest rates will decline, company will pay a variable interest rate (betting it will decrease) while receiving a fixed interest rate on the swap (betting it will be higher than the variable rate) which will decrease the total interest expense, example includes detailed accounting calculations for the swap and shows complete balance sheet journal entires for the swap contract and notes payable, income statement journal entries for the interest expense, gain or loss on notes payable, gain or loss on swap contract, detailed accounting example by Allen Mursau

Теги:

interest rate swap swap contract gain or loss present value interest rate hedge financial hedge derivative contract derivative hedge forward contract foreign currency swap cash flow default risk futures contract option contract derivative swap contract interest swap variable rate fixed rate floating interest rate fixed interest rate swap contract hedge hedge contract hedge cost

Похожие видео

Мой аккаунт

У вашего броузера проблема в совместимости с HTML5

У вашего броузера проблема в совместимости с HTML5