Sunday, 18 January, 2026г.

Где искать: по сайтам Запорожской области, статьи, видео ролики

пример: покупка автомобиля в Запорожье

Can my business appeal the findings of an IRS audit

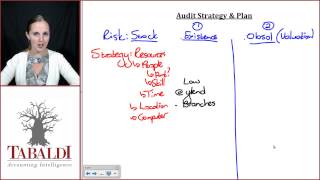

If your business has been audited by the IRS and you do not agree with the findings or conclusion it is within your rights to appeal the audit. In this short video San Diego tax attorney William Hartsock will explain the basic rules for when you can and can’t appeal a business audit. For more information about IRS audits, please visit: http://thetaxlawyer.com/irs-audit

In the event that the IRS audits you and you have somebody that's less competent helping you with the audit or you're doing it yourself, and the amount that you owe on form 4549 Income Tax Examination Changes exceeds your ability to pay, please call me. I'm more than happy to talk to you about the case. We'll have to restrategize at that point.

We'll figure out what issues there are on each one of the items. We'll discuss it, put together a strategy on how best to proceed. Then you do have the right in order to appeal it. Generally speaking, the IRS will issue a 30-day letter that gives you 30 days in order to provide additional information and documentation in order to support your case. If you miss the 30-day letter, the IRS will issue a notice of deficiency that you have 90 days to appeal to the US Tax Court in order to resolve the issue at the IRS appeals level and through area counsel level.

Теги:

IRS audit attorney tax audit attorney tax attorney advice for IRS audit IRS audit advice IRS audit preparation IRS audit process IRS cash preparing for an IRS audit what to know when being audited by the IRS audited by the IRS

Похожие видео

Мой аккаунт

У вашего броузера проблема в совместимости с HTML5

У вашего броузера проблема в совместимости с HTML5